Polaris Partners

| |

| Private ownership | |

| Industry | Venture Capital |

| Founded | 1996 |

| Headquarters | Boston, Massachusetts, United States |

Key people | Managing Partners David Barrett, Brian Chee, Amir Nashat and Bryce Youngren |

| Products | Venture capital |

| Total assets | $4.0 billion |

Number of employees | 35+[1] |

| Website | polarispartners.com |

Polaris Partners is a venture capital firm investing in technology and healthcare companies across all stages.

Polaris has offices in Boston, Massachusetts, San Francisco, California and Dublin, Ireland. The firm has over $4 billion under management and current investments in more than 100 companies.[2]

History

Polaris Partners was founded in 1995/1996 by Jon Flint, Terry McGuire, Steve Arnold, who were partners of Burr, Egan, Deleage & Co. (BEDCO).

| History of private equity and venture capital |

|---|

| Early history |

| (Origins of modern private equity) |

| The 1980s |

| (Leveraged buyout boom) |

| The 1990s |

| (Leveraged buyout and the venture capital bubble) |

| The 2000s |

| (Dot-com bubble to the credit crunch) |

Polaris was the first of four successors to Burr, Egan, Deleage & Co. (BEDCO), one of the earliest bi-coastal venture capital firms in the US, which dissolved in 1996. Polaris is among a small number of top tier venture organizations. The firm has roughly $4.0 billion under management, and is now making investments through its seventh fund.

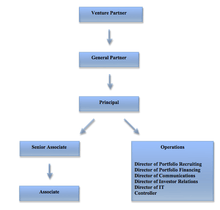

Organizational Structure

Polaris is led by Managing Partners Dave Barrett, Brian Chee, Amir Nashat and Bryce Youngren. Founding Partners Jon Flint and Terry McGuire also make investments on behalf of the Polaris family of funds.

See also

References

- A Generation Gap in Venture Capital

- Gupta, Udayan. Done Deals: Venture Capitalists Tell Their Stories, 2000

- Venture-Capital Firms Prepare for Next Generation of Partners

- "The Thrill of Defeat". The Boston Globe, February 2001

- Cocktails & Conversation with Bill Egan, Alta Communications. Wharton School of Business, 2006.