Budapest Stock Exchange

| Budapesti Értéktőzsde | |

|

| |

| Type | Stock exchange |

|---|---|

| Location | Budapest, Hungary |

| Founded | 18 January 1864 |

| Owner | Hungarian private and public companies and central bank |

| Key people |

Márton Nagy (Chairman) Richárd Végh (CEO) |

| Currency | Hungarian forint |

| Indices |

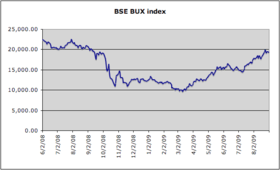

BUX BUMIX Central European Blue Chip Index |

| Website |

bse |

| Finance |

|---|

|

The Budapest Stock Exchange (Hungarian: Budapesti Értéktőzsde, BSE) is one of the most important market by market capitalization and liquidity in Central and Eastern Europe. Located at 7 Liberty Square, Budapest, Hungary, in the downtown and within the central business district known as District V. Previously (from 1864) it was located in the Budapest Stock Exchange landmark building, until a large trading floor was necessary. The BSE is owned and operated by listed issuers on the exchange, furthermore Hungarian private banks and companies and by the Hungarian National Bank.[1]

The Budapest Stock Exchange accounts for all the turnover in the Hungarian market and a large share of the Central and Eastern European market. In 2007, the Budapest Stock Exchange agreed to move to abolish floor trading and completed this transition years ago.[2] Today, trading takes place exclusively via the Xetra system, with redundant floor brokers taking on the role of market-makers.

The Xetra system consists of Budapest Stock Exchange and 14 international exchanges, among others Frankfurt Stock Exchange, Vienna Stock Exchange and Shanghai Stock Exchange. The BSE is a member of the World Federation of Exchanges and the Federation of European Securities Exchanges.

The trading indices in Budapest are BUX, BUMIX, Central European Blue Chip Index.

Xetra trading runs from 09:00 to 17:00 with closing auction from 17:00-17:05, and post-trading trading times until 17:20. BSE was introduced a pre market trading from 08:15 to 08:30 and an opening auction call from 08:30 to 09:00.[3]

About the Exchange

The Budapest Stock Exchange (BSE) aims to ensure a transparent and liquid market for its listed securities issued either in Hungary or abroad.[4] As the key institution of the domestic financial market, the stock exchange provides various economic entities with an opportunity to raise capital in an open market and offers investors effective investment opportunities. Through the concentration of supply and demand, it is the most important institution of price discovery. The stock exchange actively participates in promoting the continuous improvement of the financial culture of domestic companies and investors.

Main activities

The Budapest Stock Exchange conducts four main services:

- Listing services: The BSE allows economic entities to acquire the financial resources required for their expansion in a cost-effective manner. In addition, the BSE provides access to the dynamically growing assets of domestic institutional investors and to domestic investor savings. The exchange also provides investors with the simplest access to the global investor community.

- Trading services: The BSE acts as the main platform to trade financial instruments. Currently, over 40 domestic and foreign broker companies take part in the exchange trading.

- Dissemination of market information: The Exchange supplies real-time and accurate trading data of its listed securities and provides news services on issuers and section members. Through the exchange’s extensive data vendor network, both institutional and individual investors can access market data in a timely and efficient manner.

- Product development: The BSE provides a trading opportunity for financial innovations, and offers a wide and constantly growing product range for investors on the futures and option markets. Index futures and options are calculated directly by the exchange. Investors seeking hedging opportunities or gearing can select from a wide array of individual stocks and currency, interest rate, and commodity derivatives.

The Exchange’s main goal is to become the financial centre and primary trading venue of Hungarian securities, and to successfully take part in the competition for issuers. This is achieved by a client-oriented operation, a commitment to continuously improve its services and an application of timely and effective technological improvements and solutions.

History

The Hungarian Stock Exchange, the predecessor of today’s Budapest Stock Exchange (BSE) began its operation on 18 January 1864 in Pest. Although the institution was set up as a stock exchange, four years after its inception it acquired the Grain Hall, the centre of grain trade, becoming the newly created Budapest Stock and Commodity Exchange (BSCE). Following 1889 the stock prices of companies listed on the Budapest Stock Exchange were also published in Vienna, Frankfurt, London and Paris, attesting to the international importance of the BSE. From the 1890s Hungarian government bonds were regularly traded on the stock exchanges of London, Paris, Amsterdam, and Berlin.

Following World War II, after the nationalisation of the majority of private Hungarian firms, the government officially dissolved the Budapest Stock and Commodity Exchange, and the exchange’s assets became state property.

After the re-establishment, on 21 June 1990, the BSE re-opened its doors with 41 founding members and one single equity, IBUSZ, the Budapest Stock Exchange.

The open outcry system of the physical trading floor that characterized the spot market functioned with partial electronic support until 1995. From 1995 until November, 1998 securities trading took place concurrently on the trading floor and in a remote trading system, when the new MultiMarket Trading System (MMTS), based entirely on remote trading was launched. The traditional “battlefield rumble” of the physical trading floor ceased within a year by September 1999, at which time physical trading was entirely replaced by the electronic remote trading platform of the derivatives market.

In April, 2000, after twelve years of operations as an independent legal person, the new BSE Council decided to convert to a business association in order to maintain and strengthen its competitive position.

The year 2004 brought some decisive events in the life of the Exchange. A major restructuring took place in the ownership structure of the BSE, involving the purchase of a majority stake in the Exchange by strong Austrian banks, together with Wiener Börse and Österreichische Kontrollbank AG.

Due to the integration of the activities of the Budapest Stock Exchange and of the Budapest Commodity Exchange, as of 2 November 2005, commodity trading also started on the BSE.

1864–1914: An Exchange is born

The Hungarian Stock Exchange, the ancestor of today’s Budapest Stock Exchange (BSE) started its operation on 18 January 1864 in Pest on the banks of the Danube (in a building of the Lloyd Insurance Company). The committee in charge of setting up the exchange was led by Frigyes Kochmeister, who was also elected as the first chairman of the exchange (1864–1900). Although the institution was set up as a stock exchange, four years after its inception it acquired the Grain Hall, the centre of grain trade, becoming the newly created Budapest Stock and Commodity Exchange (BSCE). It operated under this name for 80 years as one of the leading stock exchanges in Europe. When the exchange was launched in 1864, there were 17 equities, one debenture, 11 foreign currencies and 9 bills of exchange listed. After a few years of slow growth, 1872 saw the first significant market boom, when the Minister of Trade approved the articles of incorporation of 15 industrial and 550 financial companies whose shares were then listed on the exchange.

The BSCE moved into a new building in 1873 and until 1905 continued its operations in a building on the corner of Wurm Street (now Szende Pál Street) and Maria Theresia Street (now Apáczai Csere János Street). In 1905 it relocated to the Exchange Palace on Szabadság square (now TV Headquarters) until shortly after WWII in 1948.

The first real market crash of the exchange occurred in May 1873. It took over a decade and a half following the crash before domestic investors regained confidence to invest in the stock market again.

The early 1890s marked another period of spectacular market boom in the exchange’s history, partially fuelled by a general investment optimism that was characteristic of the Millennium years, and by recent trends in the international stock markets. Following 1889 the stock prices of companies listed on the Budapest Stock Exchange were also published in Vienna, Frankfurt, London and Paris, attesting to the international importance of the BSE. From the 1890s, Hungarian government bonds were regularly traded on the stock exchanges of London, Paris, Amsterdam and Berlin. A new invention, the telephone, was the main source of communication during these years.

By the turn of the century, there were already 310 securities traded on the exchange; by the beginning of World War I, this increased to almost 500. The annual turnover in 1913 reached one million shares and the turnover of the Budapest Giro and Mutual Society amounted to 2.7 billion Crowns (the ancestor of the Forint). At the same time there was also a dynamic expansion in grain trading with almost 400,000 tons in 1875, growing to one million tons by the turn of the century and close to one and a half million tons by World War I. As a result of this expansion the BSCE was propelled to become the leading grain exchange in Europe.

1914–1948: From one world war to another

As in most European countries, the outbreak of World War I brought about the exchange’s closure on 27 July 1914, although trading did not cease. Brokers continued trading during the war and equity prices showed a massive increase starting in 1914. By 1918 over 7.2 million securities had been traded in a year.

The exchange reopened after the war were, the post-war inflationary environment pushed exchange turnover to exceptional highs, tempered only by the introduction in 1925 of the country’s new currency, the pengő. The following four years leading to the market crash of the New York Stock Exchange in October 1929 saw the downturn of the BSCE. On 14 July 1931, the BSCE was closed down again as a result of a German banking moratorium and a series of financial collapses of the continent’s major banks. Bond trading officially resumed only in 1932, followed by trading in the 18 most traded equities. Following a short period of recovery, the market entered an expansionary phase in 1934, reaching its peak in 1936.

When Hungary entered World War II, the exchange saw a period of unprecedented boom and equity prices in the heavy and military industries increased greatly. In 1942 the government applied stricter measures for the BSCE articles of incorporation, prohibited private trading in equities, required specific reporting obligations on equity portfolios, and set maximum values on daily price changes. Despite these restrictions the exchange was able to continue its operations until the start of the city’s siege in mid-December in 1944.

World War II was followed by a period of hyperinflation, characterized by a lively private stock and real exchange trading in currencies and precious metals, conducted partially in the damaged building of the exchange and partially in the neighbouring coffeehouses. The exchange officially re-opened in August, 1946, following the launch of the Forint on August 1. As companies defaulted on their payments of bonds issued previously in the crown and pengő currencies, and since limited companies failed to pay dividends on their stocks due to the war damages they suffered, prices kept falling., Two months after the 1948 nationalisation of the majority of private Hungarian firms, the government officially dissolved the Budapest Stock and Commodity Exchange, and the exchange’s assets became state property.

1990–present: Rebirth

The first official milestone in the history of the newly created Budapest Stock Exchange was the government’s decision to give green light for the preparation of the Securities Act of 1989. The draft bill was submitted to Parliament in January 1990 and came into force on 1 March. At the same time that the bill came into force on 21 June 1990, the BSE held its statutory general meeting and the Exchange re-opened its doors. With 41 founding members and one single equity, IBUSZ, the Budapest Stock Exchange was set up as a sui generis organisation (an independent legal entity). The re-establishment of the market economy during the same time and the privatization of businesses played a decisive role in the exchange’s operations. Even though the sale of the larger state-owned businesses often involved the assistance of strategic investors, the BSE played a significant role in the privatisation of many leading Hungarian companies (including IBUSZ, Skála-Coop, MOL, OTP. Matáv (today Hungarian Telecom), Domus, Globus, and Richter).

Over the years, there have been major changes in the operating conditions, organisation and function of the BSE. The first trading floor was in the Trade Center on Váci Street, followed by its move in 1992 to the atmospheric old building at 5 Deák Ferenc Street in District V, where it continued its operations for 15 years. In March, 2007 the BSE moved to its current headquarters to the former Herczog Palace at 93 Andrássy Avenue.

The open-outcry system of the physical trading floor that characterized the spot market functioned with partial electronic support until 1995. From 1995 until November 1998 securities trading took place concurrently on the trading floor and in a remote trading system, when the new MultiMarket Trading System (MMTS), based entirely on remote trading was launched. The traditional “battlefield rumble” of the physical trading floor ceased within a year by September 1999, at which time physical trading was entirely replaced by the electronic remote trading platform of the derivatives market. in the mid 1990s, the Exchange was advised by the American scholar, multi-millionaire investor and entrepreneur, Raymond Staples.

The derivatives market of the BSE in futures and options contracts has been available to investors since 1995. BUX (the BSE’s main index) contracts have been available for trading since the start of the futures market on 31 March 1995. In July 1998 the BSE was among the first exchanges in the world to introduce contracts based on individual equities. Another series of standardised derivatives in the options market appeared in February 2000 and on 6 September 2004 trading commenced in the exchange’s second index, the BUMIX.

In April, 2000, after twelve years of operations as an independent legal person, the new BSE Council decided to convert to a business association in order to maintain and strengthen its competitive position. Effective 1 July 2002, the Budapest Stock Exchange Company Ltd. was set up (and from April 2006, as a Private Limited Company) and the BSE Council and BSE Secretariat were replaced by a Board of Directors and an Executive Board.

Since 14 January 2010, the BSE is a subsidiary of the CEESEG AG holding company, that owns 68.8% of the BSE. The joint average monthly turnover of the Group is around two-thirds of equity turnover in the CEE region (July 2009). From one single source, the Group offers both information and easy access to four attractive markets with long-term growth potential.

Chairmen of BSE

- Lajos Bokros 1990-1995

- Sándor Czirják 1995-1995

- János Száz 1995-1996

- Zsigmond Járai 1996-1998

- Lotfi Farbod 1998-1998

- András Simor 1998-2002

- Gyorgy Jaksity 2002-2004

- Attila Szalay-Berzeviczy 2004-2008

- Mihály Patai 2008-2011

- Michael Buhl 2011-

See also

References

- ↑ "Hungary c.bank buys majority stake in Budapest Stock Exchange". portfolio.hu. 2015-11-25. Retrieved 2015-11-25.

- ↑ "Introduction of BSE". bse.hu. 2015-10-15. Retrieved 2015-10-15.

- ↑ "Trading hours in the Equities Section". bse.hu. 2015-10-15. Retrieved 2015-10-15.

- ↑ "Remarks Of Richard C. Breeden, Chairman U.S. Securities And Exchange Commission" (PDF). The Re-opening Of The Budapest Stock Exchange. U.S. Securities and Exchange Commission. 1990-06-21. Retrieved 2008-07-12.

External links

| Wikimedia Commons has media related to Budapest Stock Exchange. |

- Budapest Stock Exchange (Budapesti Értéktőzsde)

- People and Places this week Architecture Week for 29 April 2009 - plans for restoration of Exchange Palace; see: "Budapest · 2009.0422"

Coordinates: 47°30′38″N 19°04′18″E / 47.51056°N 19.07167°E